Posted by Founder, Bicycling Monterey

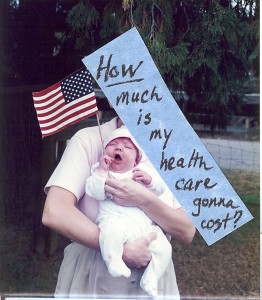

Beware of Limited-Benefit Health Insurance Plans: Why a Daughter of the American Revolution Just May Flee the Country

A front-page story in the July 1 New York Times, “Insured but Unprotected…” by Reed Abelson, could be critical to any American with health insurance.

Yesterday I was on the phone to Anthem Blue Cross of California, my insurer since 1993. Prior to ’93, for many years I had my family on Co-op America‘s health insurance plan through Consumers United. I loved that plan, because its coverage options included now-popular alternatives such as midwives and acupuncture. Many other insurers recognize these today, though usually with unwarranted under-coverage, but Co-op America was ahead of its time.

My life insurance agent had cautioned me, though, that the plan had only a B+ Best rating, so I did keep an eye on it. And sure enough, the plan went belly-up, though Co-op America (since renamed Green America) negotiated a deal to secure coverage with Blue Cross for all of us who’d been on the Co-op America plan.

Since then, like most Americans, I have watched with concern as my premiums shot up. As a longtime self-employed person, hefty premiums are a harsh reality. Currently I pay $850/month for a Blue Cross PPO plan for my family–now just a 20-yr-old and myself. It’s unfortunate for small families that the same rate applies for a two-member family as for a larger family, but that’s how the system operates.

A Daughter of the American Revolution, at Risk of Being Uninsured

High premiums are enough to make me wish I could add a 20-hr barista job to my schedule–if Starbucks wasn’t closing stores–so I could have paid health insurance! That would leave a helpful $850 in my monthly budget for actual health care. (Health insurance and health care are two different things, a fact too often overlooked.)

Seriously, employer-paid health insurance may appear to be the best solution to our problems, but it’s already a significant part of our nation’s system–the system that isn’t working. We need fresh perspectives. One source of these is Matt Miller’s book The Tyranny of Dead Ideas.

Yesterday’s call to Anthem BC was to check on current rates for other plans. Earlier this year, I spent many hours researching options to change my coverage. It was disheartening to realize then–as I confirmed again yesterday–that there is no way to save money without going to a plan with coverage that is not really recommended.

What to do? One option is to switch to a plan that has no drug coverage. I ran this idea by my primary care physician of 25 yrs. I told her that the Blue Cross advisers urged me not to do it; one adviser said she was formerly in a department there where insureds called her, in tears, because they had no drug coverage–and of course, though they needed it now, Blue Cross wouldn’t allow them to purchase that coverage.

Regardless, switching to a non-PPO plan that allows dropping both generic and brand-name drug coverage would save $193/month or $2,316 annually. It’s worth considering, since that money that could be used toward the cost of health-building (rather than symptom-treatment) approaches. Examples of health-building costs include the myriad of under-covered but effective treatments, such as osteopathy and acupuncture; or uncovered, preventative care like massage and yoga classes. Besides those, it could be extra money available for dental and vision care. All of these and more–on top of paying a hefty (for me, $850) monthly premium–PPO insureds must personally pay for; this is in addition to the cost of co-pay percentages, annual deductibles, and annual out-of-pocket maximums for conventional care.

When I checked out the idea of dropping drug coverage with my longtime doc, who I deeply respect, I told her of the Blue Cross adviser’s stern warning not to drop it. My doctor responded, “Yes, but neither of you take any medications!” “I know,” I agreed, “but the Blue Cross rep was adamant about not letting that coverage go, saying you never know when your health status could change…” My caring doc’s sincere response: “Sure, there’s always fear.”

Indeed I wrestle with the whole concept of fear when I weigh out what level of insurance coverage is really necessary in my life. And deciphering the various plans is not easy. In fact, full-time agents I consulted with seemed to understand my insurance options even less than I did. And as Abelson’s story cautions, too many consumers purchase limited-benefit health plans that can lead to bankruptcy if a health crisis happens. He quoted Elizabeth Warren, a Harvard law professor who has analyzed medical bankruptcies: “Underinsurance is the great hidden risk of the American health care system.”

I’m a pretty savvy insurance consumer. Twenty years back, my articles published in national magazines included the subject of health insurance. But in the intervening years, I have thrown up my hands at trying to stay up on all the policy addendums Blue Cross sends my way. Now, instead of carefully reading them and staying well-informed, I skim them and stuff them in the bloated Blue Cross file. I find myself wondering: if I am no longer able to keep up with all the nuances of health coverage, what’s a less literate and informed consumer expected to do!

Five years ago, another California entrepreneur–who has the same Blue Cross PPO plan that I have–told me of her battle to get Blue Cross to pay for a surgery that our policy was supposed to cover. It took her two years of fighting with our insurance company before they finally paid her claim. In the end, the medical director of Blue Cross in essence admitted to her that they have about six roadblocks–intended to wear down their insureds–before the insurance company will pay.

This woman had to take many actions, including filing with the state insurance commission, making conference calls to the Blue Cross medical director and the chairman of the committee that decides on coverage of new procedures, and more. She is one of my heroes, for she basically wore the insurance industry down before they could wear her down.

She wasn’t fighting just for herself though, but for other insureds who would need the same procedure. (In fact, her groundbreaking work did have a far-reaching positive impact.) This woman has tenacity plus, and she knew that not every insured–especially someone very ill–would have the strength or resources to fight the system as she had.

As Abelson’s story points out, insurance companies are “too prone to confuse their customers and dump the sick.”

A couple more critical points from his story:

Last year, a friend recommended, “don’t worry, when you get older, you can get cheaper health insurance through AARP.” But Abelson’s article provides a wise warning: limited-coverage plans offered by UnitedHealth through AARP “drew sharp criticism…” and after “Senator Grassley began investigating its sales practices, UnitedHealth agreed to stop.” So much for an easy fix when you reach the AARP-membership age of 55!

Abelson’s article also mentioned that the man who is the subject of his story had reached 65 and “qualifies for Medicare” so “his future insurance problems are largely solved.” But don’t assume you will later qualify for Medicare. I was amazed when another friend told me what happened with her husband, who was over 65 and had worked for the federal government for decades. When he reached his scheduled retirement date, he was surprised to learn he didn’t qualify for Medicare. Just in time, he learned that he had to first work longer, or he would not have been eligible.

It’s a jungle out there, folks. Stay alert.

My 20-year-old, a very compassionate young woman, is working toward a career in health care. Even at her young age, she is already acutely aware of the problems with our health-care system. What’s her idea for getting out of the jungle? After watching Michael Moore’s movie Sicko, she lamented, “I may just move out of the US.” How sad that a Daughter of the American Revolution may feel driven from the the US–the nation her ancestors fought to establish–only because she wants to live where competent health care is affordable for everyone.

This post was published on 1 July 2009. One or more changes last made to this post on 11 June 2017.

I found myself thinking, as I read the last paragraph of your entry, about how many revolutions America has had….There has been the fight for independence, the fight for the abolishment of slavery and for racial equality, for women’s rights… Your country has taken such great strides to level the playing field for all participants, yet divisions exist still.

I don’t claim to know how, exactly, the Canadian health care system works in entirety; it has its flaws, like anything else. But there is no division in Canada between those who can be healed and those who cannot….not any division decided by any person, anyway…

I am a Canadian and I stand by my country’s health care system. I wouldn’t be here without it. The level of care isn’t substandard, and people pay what they can. I pay very little, if anything, into it annually; whereas those who make more, pay more. It works out…. somehow. We have to pick up the tab for our own dental insurance, and there are private health plans emerging with more comprehensive coverage, but I’ve never heard of anyone paying $850/month. I hope America finds a better way of doing things.

This is an issue I revisit on a yearly basis, as I decide which insurance plans to place on my list of alternate plans for our international students. The student plan sponsored by our university offers excellent coverage, but is also very expensive for a student, so I find myself listing plans that are essentially one step up from disaster coverage. Explaining the screwed-up healthcare system in the U.S. to international students from countries with national health coverage is always interesting. Part of my job also includes explaining the plans to our students, helping them navigate the maze of coverage, and all too often, having to say “that’s not covered by the plan you chose.”

As an employee of a university connected to a fantastic hospital and medical school, I am blessed to have amazing health coverage. At the same time, as a public health student I am well aware of the issues with our healthcare system. Like you said, the problem is not just with those who are uninsured. The plight of the underinsured gets less coverage and, in the end, can be even more devastating. If you haven’t read it, I recommend “Sick” by Jonathan Cohn for one take on the problem.

In one of my public health classes, our professor opened the session with a simple question: “Is healthcare a right or a privilege?” The resulting debate – and yes, it turns out it *was* a debatable issue – was fascinating. I don’t know how to fix our healthcare system, although if it was that easy it probably would have been done by now. 🙂 Still, I come down firmly on the side of healthcare being a basic human right. I wish I knew how to make that happen.

So true! All good points, and ones I wholeheartedly agree with.

I wish there were other options, something more middle ground than either having to pay exorbitant amounts of money or leaving the country altogether.

And the issue of fear is a huge one, especially for someone as young as myself who doesn’t have much knowledge of how insurance works.

I have that United Health/AARP coverage you mentioned.

It is basically like a major medical, catastrophic plan – – a $2500. deductible. And there are no co-pays, so basically I just don’t buy medicines, or go to the doctor, unless I am desperate.

One thing I did notice, though, when getting bloodwork, is that since I did have insurance, since I had to pay for it directly, they charged me the rate that was cheaper with the insurance, than if I just wrote a check as an uninsured person. The money saved basically paid my premium for the month.

And the drug coverage is worth the extra money, I believe – – if I need anything, there is always money saved, and I figure that is like a discount on the premium each month.

Being basically healthy persons, this purchase and retaining of health insurance (which is So Different from health care, as you mentioned – – another conversation) is definitely based on a Fear Factor – – and I hate that. But – – my parents would have absolutely Sunk Financially if they

didn’t have health coverage…

So I trudge on, scraping to pay my premium, feeling guilty because my partner doesn’t have health insurance…